CROX Generational Buying Opportunity?

In this post I will discuss my hypothesis on CROX and will make a point for why we might have a once in a generation buying opportunity for the company at the moment.

Crocs, A 20 Year Old Clogs Manufacturer With >58% Gross Margins

CROX has been been on my radar for a while as I believe the company to have a strong brand reputation within a competitive market and has the ability for future growth around the world.

I will first analyze the fundamentals of Crocs before presenting my case to why I think that we have a very rare opportunity in our current market to buy a value/under-valued stock.

Background on Crocs

“Crocs, Inc., together with its subsidiaries, designs, develops, manufactures, markets, distributes, and sells casual lifestyle footwear and accessories for men, women, and children under Crocs and HEYDUDE Brand in the United States and internationally.” stockanalysis.com

I’m sure everybody reading this has heard of Crocs or even owns a pair. They are a household name which have expanded by purchasing HeyDude, another shoe brand, in 2022.

HeyDude was a fast-growing brand endorsed by celebrities on social media purchased by Crocs for $2.5 Billion in 2022. Many investors have been skeptical of this new brands results and forecasts which is the reason the stock has plummeted 20% in the past week but I believe this to be an extreme over-reaction from the market. I believe HeyDude to be a defensive move for Crocs and not an acquisition intended to grow revenue’s an absurd amount.

Crocs have been growing their revenues year on year despite negative forecasts about their HeyDude line.

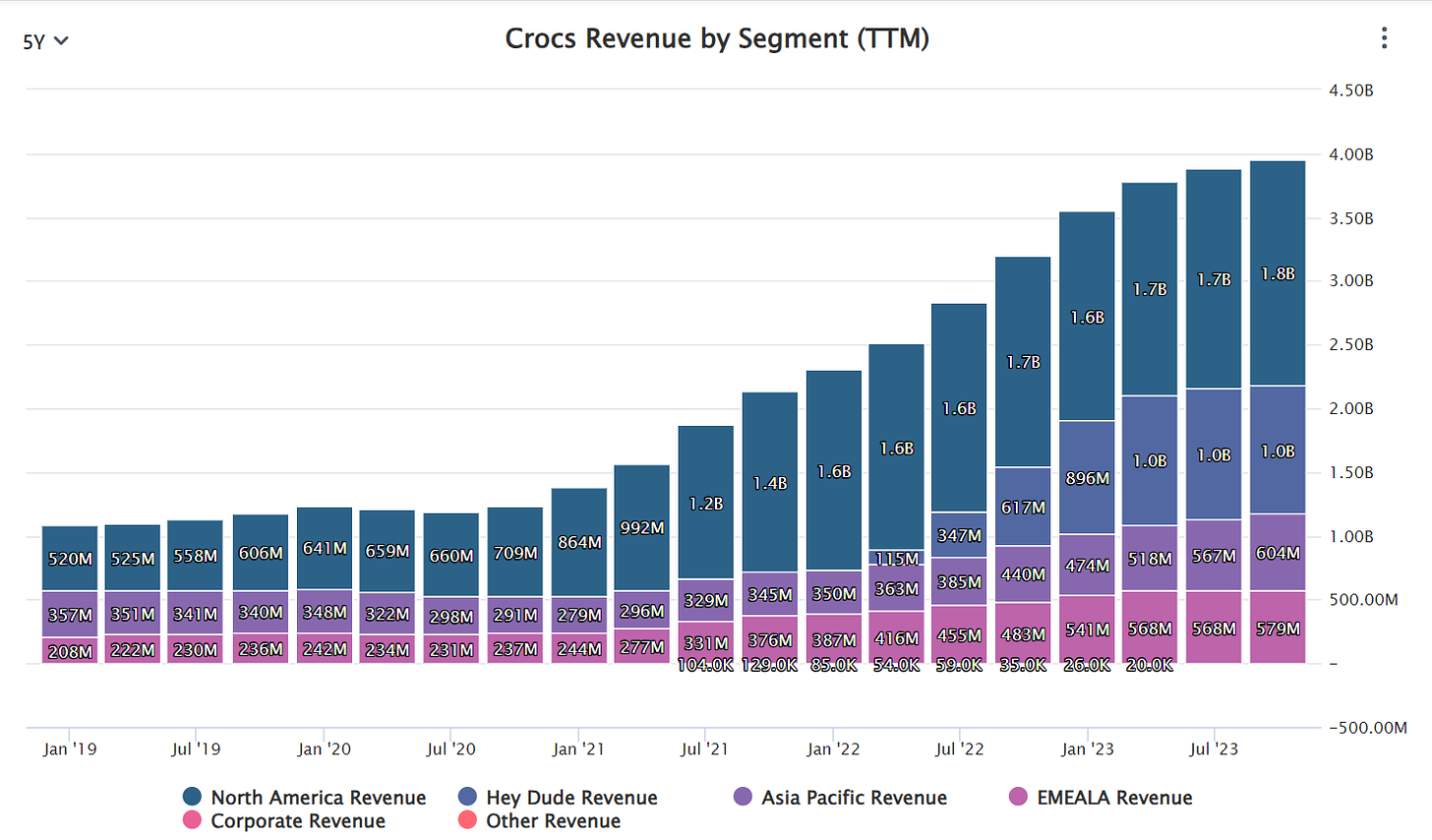

Below is a graph showing Crocs revenue broken up by segment. As we can see HeyDude represents $1.08 Billion in revenue compared to the roughly $3 Billion from Crocs.

Fundamentals and Financials

Gross Profits

In the past 5 years CROX have grown their gross profits from 620 Million to 2.3 Billion this year which represent a 300% growth or 50% growth per year.

Share Buy Backs

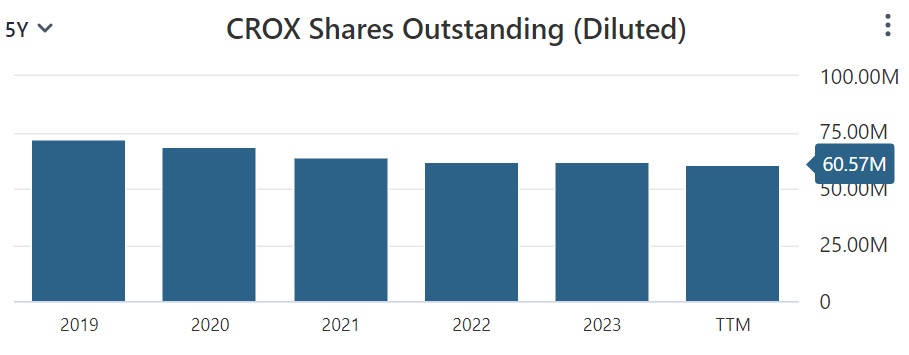

Furthermore, CROX have been aggressively buying back stocks with their profits so that in the last 5 years that have reduced their shares outstanding from 71.7 million to 60.5 million. This share buy-back program is in part responsible for the amazing growth CROX have had in the last 5 years

Incredible Margins

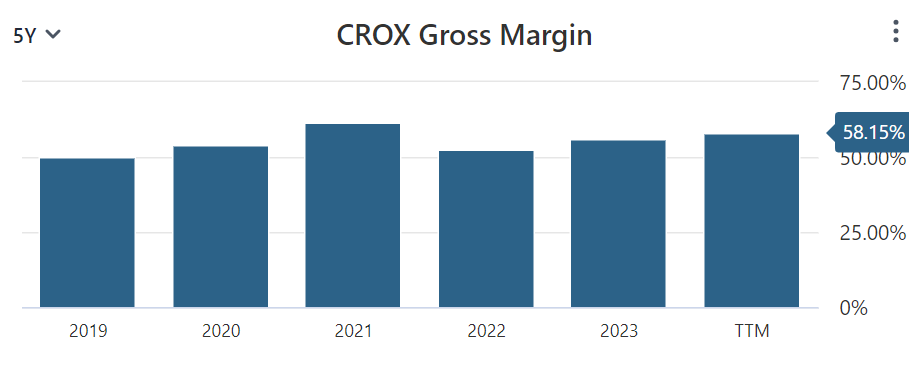

CROX boasts some incredible margins for their industry. With a 58% gross margin and 20.5% profit margin which are both exceptional. Their margins have remained steady in the last five year which goes to show their dominant positioning in the sector.

Large Cash Pile

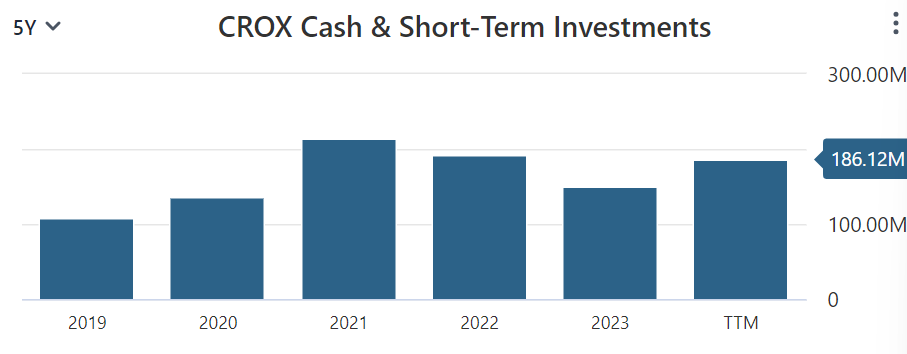

CROX has frown their cash and short-term investments funds from 108 million in 2019 to 186 million this year which is a solid amount for a company of it’s size with it’s low amount of short-term debts.

Manageable Amounts Of Debt

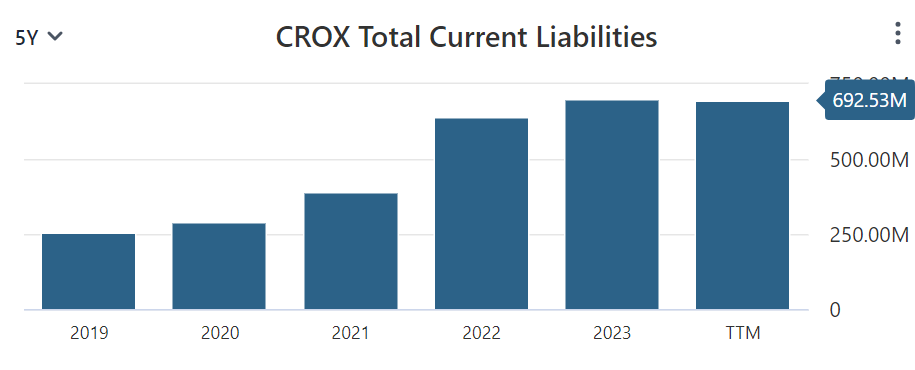

Since it bought HeyDude back in 2022 CROX has been reducing it’s total liabilities which amounted to $3.6 billion after it’s acquisition in 2022. Current liabilities amount for almost $700 million in the trailing twelve months which is a high amount but can be paid off with receivables and cash.

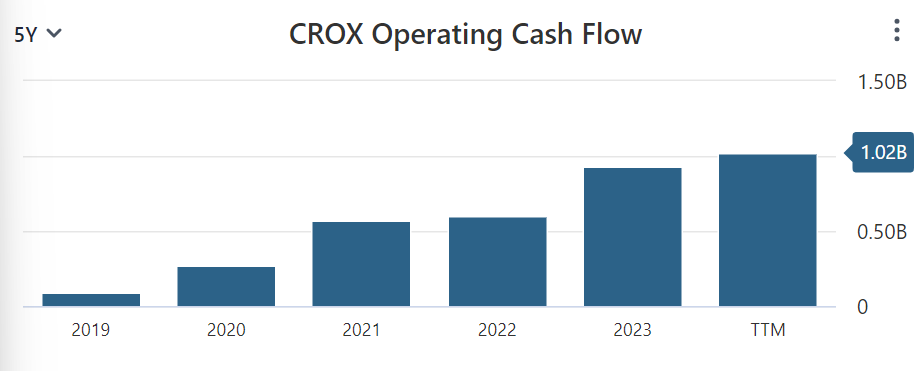

Cash Flows

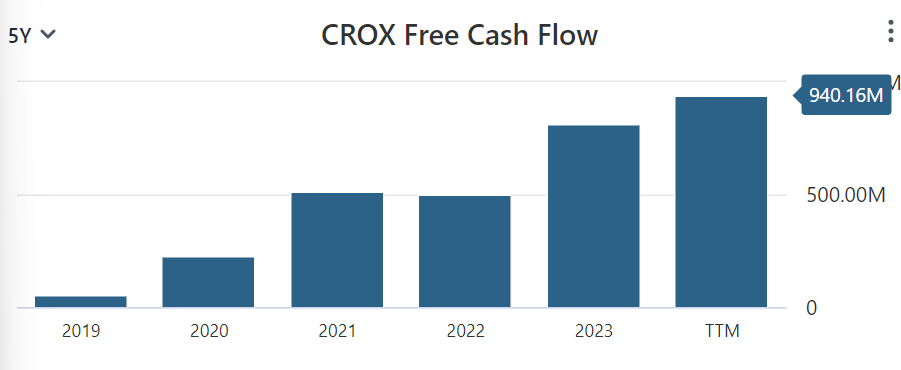

CROX manages to improve their cash flow’s year on year highlighted by their incredible operating income growth in the last five years as well as their free cash flow growth despite repurchasing on average $400 million of shares every year.

Here we see that operating income has gone from $90 million in 2019 to $1 billion in 2024 and has been steadily increasing each year.

CROX have been growing their free cash flow every year and continue to prove that their business model is solid and a cash flow cow.

Why CROX is Currently Trading Low

In CROX recent earnings report they reported third quarter revenue increases (by 2%), Crocs brand growth 8% and a diluted EPS up 17%. Overall the earnings report was positive however some weary investors have become scared from the fact that HeyDude’s revenue decreased by 17.4%.

The negative news about the HeyDude brand is the reason for the 20% drop in CROX stock price. Investors have outweighed HeyDude’s overall impact on Crocs financials and have gotten scared. As you have seen, Crocs has very strong financials and despite HeyDude’s decrease in sales they still improved almost all all metrics this quarter.

Why CROX is an Excellent Buy Now

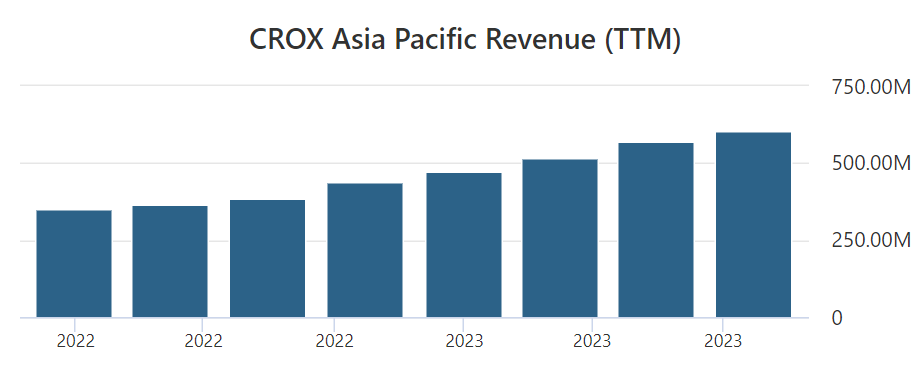

Growth Potential In Asia

Asia is the largest market in the world and Crocs’ brand have recognized this and have began to tap into the huge market for fashionable branded footwear apparel. Despite a steady revenue in North America and slight increases in Europe, Asia has a large rom for growth in terms of revenue expansion. With North America currently accounting for $1.7 Billion in revenue per quarter whereas Asia is only bringing in $604 Million.

Valuation Metrics

In the current economy it is rare to find a stock trading for a cheap price however Crocs is a rare exception with a PE of on 7.8 and a forward PE of 8.4. This type of valuation in this market is extremely rare, especially given the strong performance of the company.

Insider Buying (Yesterday!)

Normally it is a good sign when insiders have bought a share of their company within the last 3 months however in this case a director at crocs bought 2,240 shares of the company yesterday increasing his stake in the company by around 32%.

Peter Lynch - "insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise."

Conclusion

I believe that an opportunity to buy a stock like Crocs for this price is extremely rare in today’s market and only comes about a few times per decade for any given stock.

I urge you to do some research into the stock and consider whether it would be a good investment for you.

My Rating

Income: 7.4/10

Balance Sheet: 8.1/10

Cash Flow: 9/10